Difference between Form 16 and Form 16A

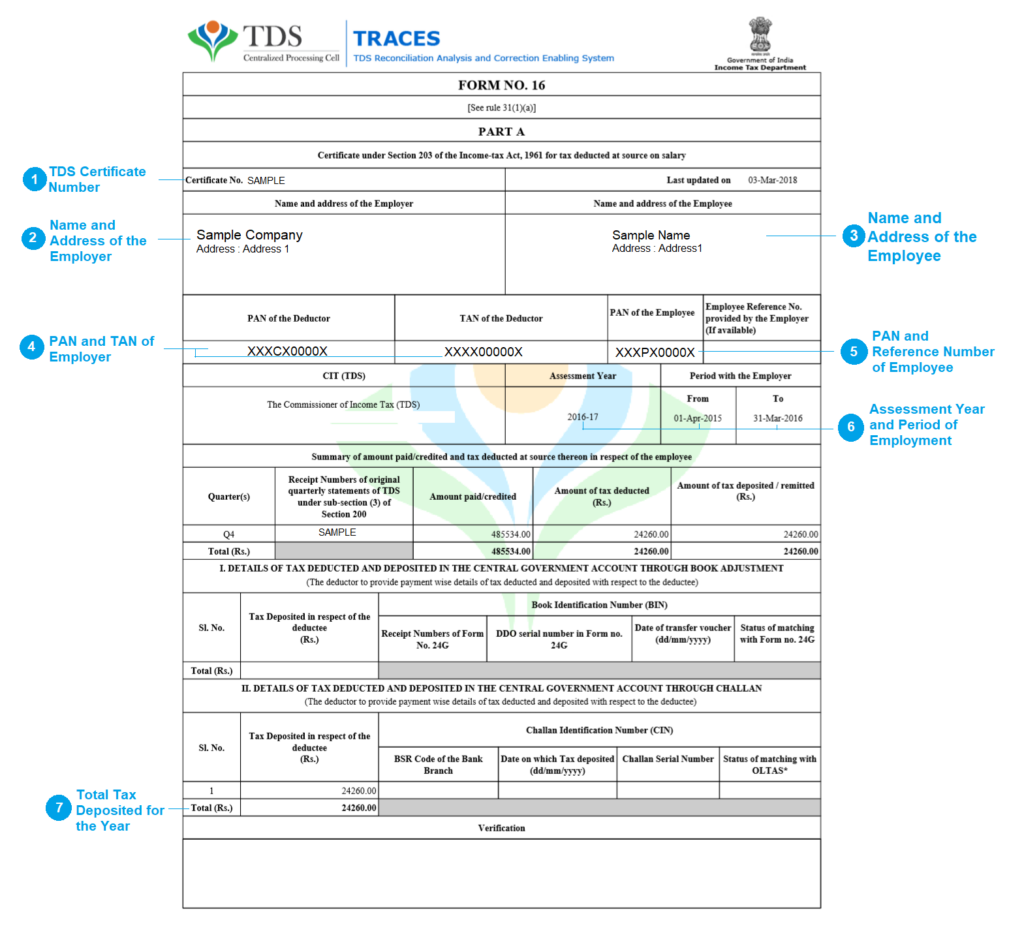

Form 16 is a certificate provided by employers to their employees. It reports that TDS has been deducted and deposited to the government authorities on behalf of the employee. It gives a detailed information of the salary paid to the employee and the TDS amount deducted by the employer.

Part A has information of the employer & employee, like name & address, PAN and TAN details, the period of employment, details of TDS deducted & deposited with the government. Part B includes details of salary paid, deductions and exemptions done by the employer.

What is Form 16 A?

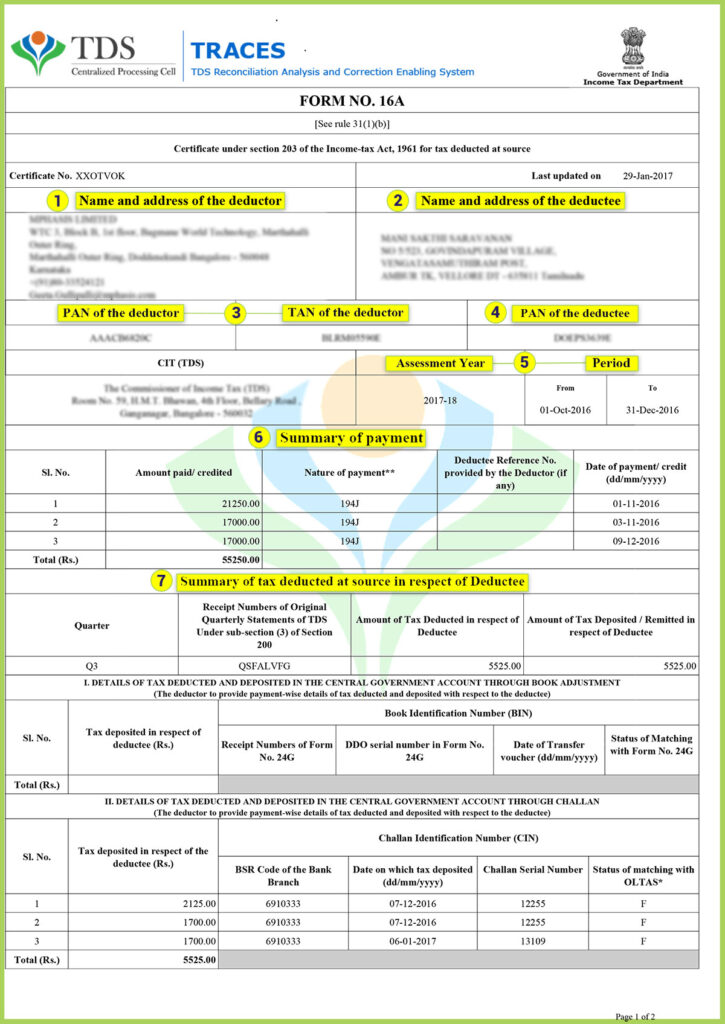

Form 16A is the certificate of deduction of tax and issued on deduction of tax by the employer on behalf of the employees.

These certificates contains details of TDS / TCS for various transactions between deductor and deductee.

Major Difference between Form 16 and form 16A:

| FORM 16: | FORM 16A: |

| Form 16 will be received by a salaried person | Form 16 A will be received by an individual , whose source of income is other than salaries. |

| Employer and employee relationship is mandatory. | Deductor and deductee relationship is required. |

| In form 16 slab rates will be applied to deduct TDS. | No deductions and excemptions will be applied. |

| Income Tax is calculated on the basis of slab rates. | Income tax is calculated on the basis of flat rates.(like 10%, 15%, 30%) |

| Incomes under section 192 is covered in the Form-16 | Incomes under section 194 A, 194J, 194JB are covered. |

| Person who earns salary income will get form 16 | Person who earns professional service, fee, commission, bank interest will get form 16 A. |

| It is issued once in a year | It is issued in quarterly basis(Q1, Q2,Q3,Q4). |