Difference between 26AS & AIS

September 19, 2022

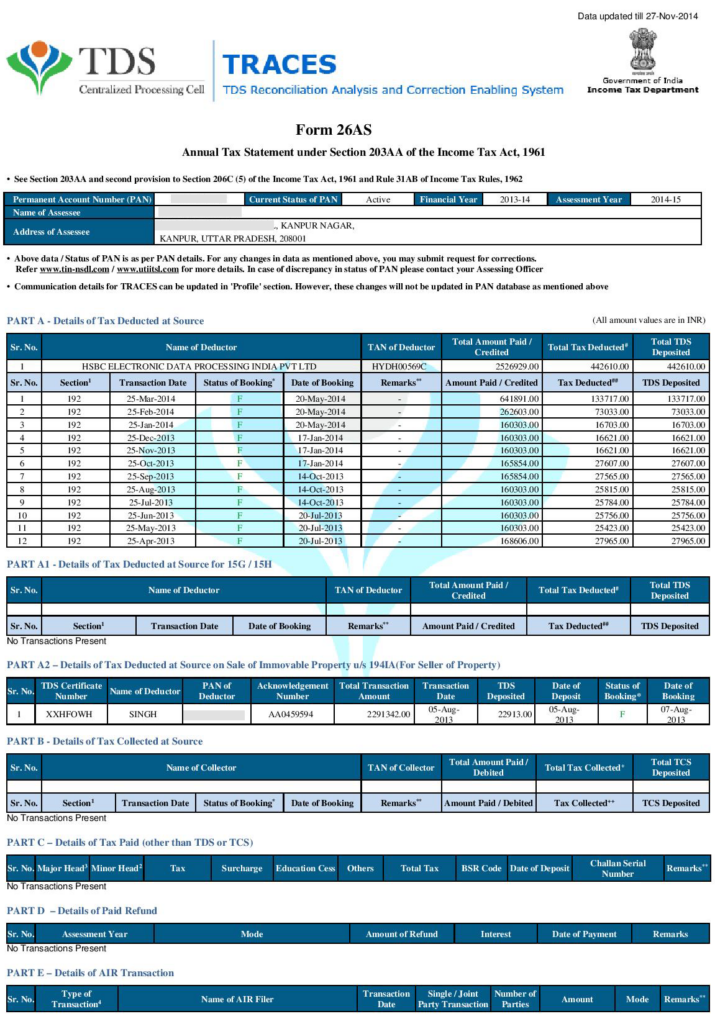

FORM 26AS

Form 26AS is also known as the tax passbook. Contains information about taxes withheld from & deposited against the PAN of individual during a financial year.

26AS viewed as

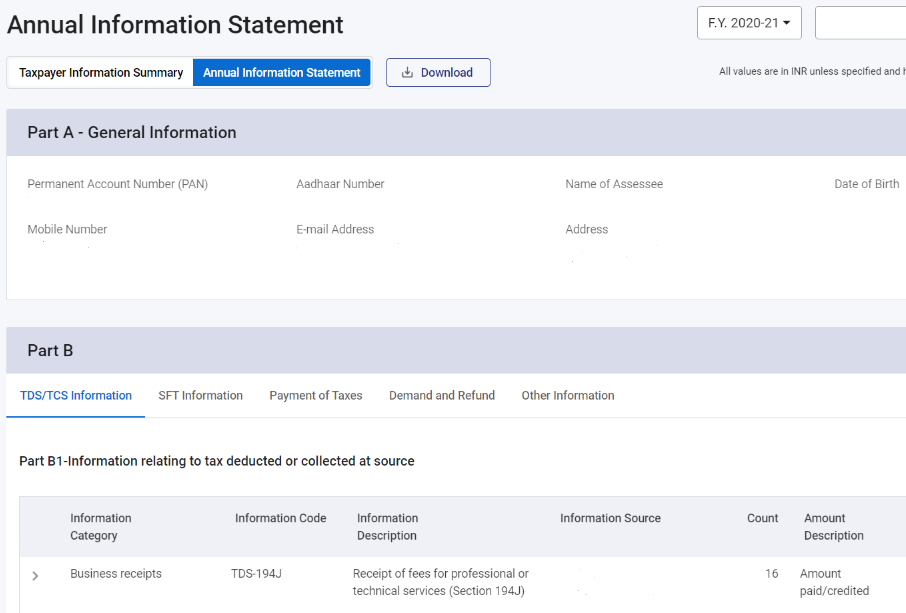

AIS

The AIS is a detail statement contains financial transactions done by you and reported by various entities of financial institutions to the tax department during a Financial year.

AIS viewed in portal

Major Differences of 26AS & AIS

| 26AS | AIS |

| Present & previous years Financial transactions can be visible. | Only present year Financial transactions can be visible. |

| 26AS will be reported in monthly basis. | Day to day transactions can be reported. |

| General information can be seen. | In AIS, different bank accounts and general information can be seen. |

| Only Fixed deposit interest will be reported. | Savings interest and FD interest is reported. |

| Transaction amounts will be reported. | Transaction amount and account number will be reported. |