Importance and how to Download AIS

September 16, 2022

Importance of AIS

- The AIS is a detailed statement that contains all of your financial transactions for a given financial year (FY)

- The AIS includes information on interest, dividends, stock trades, mutual fund activities, international remittance details, etc.

- Moreover, some presented approaches can approximate AIS data with higher accuracy than the classical linear interpolation.

- All the information is available in aggregate form as well as individual transaction wise.

Objectives of AIS

- Annual Information Statement (AIS) is a much detailed statement.

- Displaying complete information to the taxpayer with a facility to capture online feedback.

- Promote voluntary compliance and enable seamless prefilling of return

- Taxpayers will be able to submit online feedback on AIS’s information and download information in PDF.

How to Download AIS

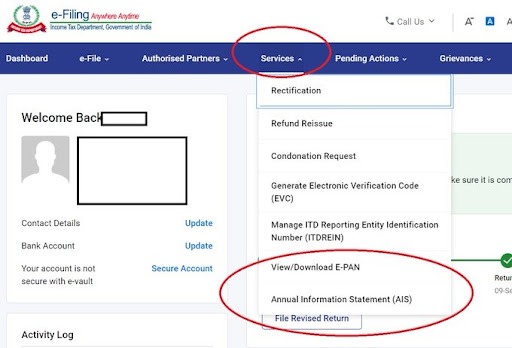

Step 1 – Login to income tax e-filing portal, https://www.incometax.gov.in/iec/foportal using the PAN CARD & your password.

Step 2 – Then Go to the ‘Services’ top section & click on ‘Annual Information Statement (AIS). Income tax

Step 3– Choose either the PDF or the JSON option & click on ‘Download’.

Step 4 – Click PDF & enter the right password.

Step 5 – Password for AIS report is PAN and your date of birth. For example, if your PAN is ABCDE1234F and your DOB id 01/01/1978 then the password to open the document will be “abcde1234f01011978” (in lower case).